What exactly is home financing Processor chip, and What is Their Part?

- An interest rate processor chip is actually an option professional regarding the financial lending techniques.

- They try to be a good liaison within mortgage administrator, underwriter, and borrower.

- Loan processors have the effect of get together and you will organizing loan application data files.

- It be certain that the new completeness and you will accuracy of the mortgage file in advance of underwriting.

- Processors enjoy a crucial role inside the making certain compliance with credit rules.

- Their work is important for a soft and you will successful home loan approval process.

- Examining the borrower’s credit rating is vital, because it boasts checking to own inaccuracies and you can examining percentage patterns so you can view creditworthiness, and therefore definitely influences home loan recognition possibility.

Introduction

When you apply for a mortgage, several positives works behind-the-scenes to make your homeownership goals toward truth. Perhaps one of the most important yet , often skipped roles inside processes would be the fact of the mortgage chip. Home mortgage officers installment loans New Jersey and real estate loan originators along with gamble key roles, making certain obvious communications and you will expertise having processors and underwriters to help you navigate the reasons having resource. Given that a talented mortgage expert, I have seen firsthand just how essential loan processors are to the mortgage world. Inside book, we are going to speak about what an interest rate processor do, why the character is so crucial, and just how they sign up to your home to find travels.

Knowing the Mortgage Processor Role

A mortgage processor chip is actually an economic elite group exactly who performs an effective pivotal role in the financial financing procedure. It serve as brand new bridge between your mortgage officer, whom work myself towards borrower, together with underwriter, just who helps to make the concluding decision towards mortgage acceptance. Contrasting the latest borrower’s credit score is extremely important on loan recognition processes, as it assists measure the individual’s past credit efficiency and risk level. The fresh processor’s first duty is always to prepare the borrowed funds file for underwriting of the ensuring all the needed documents is obtainable, particular, and you may agreeable with credit requirements.

Methods for Early Homeloan payment

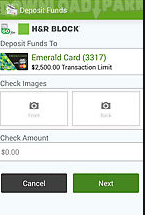

- Evidence of earnings (W-2s, shell out stubs, tax returns)

- Bank statements

The necessity of Home loan Processors

Home loan handling are reveal process that involves numerous grade and portion, centering on the chance of problems therefore the dependence on compliance with regulatory standards.

Skills and Qualifications

Of numerous processors have bachelor’s values during the funds, team, otherwise associated sphere, no matter if it is far from constantly needed. Experience, like the Specialized Home loan Chip (CMP) designation, can boost a good processor’s credentials and you can assistance.

Well-known Misunderstandings

Reality: Financing officers performs individually having clients so you can originate funds, while you are processors focus on getting ready the loan apply for underwriting. Home loan officers was signed up experts who come together directly that have processors to ensure a delicate home loan credit processes.

How DSLD Financial Utilizes Competent Processors

Our functions specifically focus on mortgage loans, making sure all of us is actually better-able to handle all facets of financial credit procedure.

Conclusion: Brand new Unsung Heroes regarding Home loan Credit

Mortgage loan processors are the newest unsung heroes of one’s credit world. Their careful works behind-the-scenes is very important to possess flipping their financial application with the an approved loan. Of the ensuring accuracy, conformity, and you may completeness of one’s financing file, processors gamble a crucial role in assisting you accomplish your homeownership requires. Financial processors are crucial when you look at the organizing paperwork, guaranteeing borrower guidance, and making certain most of the called for records try done prior to submitting into mortgage underwriter.

Knowing the part away from an interest rate processor makes it possible to enjoy the complexities of your mortgage credit processes therefore the pros regarding getting comprehensive and specific suggestions when applying for that loan. In addition shows as to why choosing a lender which have competent and you will educated processors, instance DSLD Financial, renders a significant difference of your property to order journey.

If you are considering applying for a home loan and now have questions about the process or perhaps the positions of numerous professionals inside it, please reach out to us in the DSLD Financial. We out-of educated mortgage officers and processors will be here to help you guide you using every step of your financial software processes, guaranteeing a softer road to homeownership.

Consider, when you will most likely not collaborate really along with your mortgage chip, the patient work is a critical component inside flipping your homeownership ambitions towards the facts. At the DSLD Financial, we’re committed to leveraging the services of all of our processors as well as we professionals to provide you with the best possible home loan experience.

No Comments