Choosing financing for a residential property varies – this is what you need to know

How will you go about opting for a good investment loan that won’t wind up causing you economic discomfort? Property credit pro places in their a couple of cents’ worthy of on how to pick just the right loan to you personally, plus the trick questions to ask the financial.

Committing to possessions will likely be a worthwhile promotion, nevertheless needs significant financial resources, and if you are provided committing to a property, obtaining an investment loan offer the administrative centre you will want to start-off.

However, selecting the right mortgage for the money spent makes all of the the difference with respect to strengthening a profitable possessions profile.

To get an additional property is a tiny different to buying your earliest, once the there can be a lot more to take into consideration when it comes to your own method and you will expectations, says Bankwest General Manager – Property, Peter Bouhlas.

Because of so many loan options available, it may be overwhelming understand how to start however, Peter claims undertaking this new foundation to learn your current finances try a great lay.

Be it your first investment property otherwise you are searching to incorporate into portfolio, they are the issues to inquire of your lender to help you select a loan this is the correct fit for debt wants.

Which are the current interest rates?

The rate tend to impact the complete matter your pay-off more the life of one’s financing, and it can somewhat perception your own earnings.

Interest levels to own financial support funds are usually higher than men and women for owner-filled money, but they can differ rather ranging from loan providers, making it required to evaluate rates and you may research rates having the best deal.

Men and women looking to invest in a rental property can find monetary masters when you look at the this, but you will find several a few, such just what section provides higher tenant request, while the some other rates of interest readily available for buyers than the manager-occupiers, Peter states.

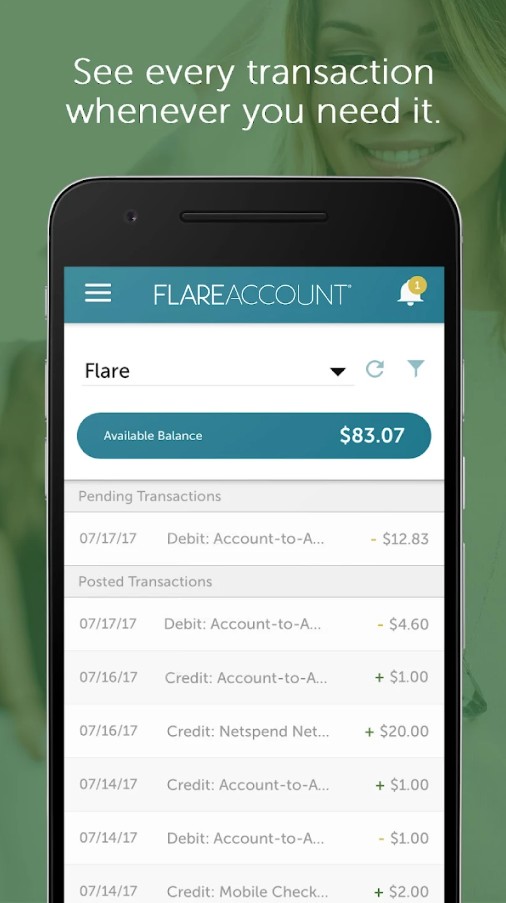

If you have several money otherwise features, it will be worthwhile contacting the lender otherwise agent, that will help explain the processes and provide you with a notion out of what your finances might look particularly just after.

Just what mortgage choices are offered?

Variable-speed funds want price which can change over big date, when you’re repaired-speed funds has actually a set rate of interest having a particular period.

Every type of mortgage has its own pros and cons. Variable-rates funds also provide liberty minimizing very first will cost you, when you are repaired-price finance offer safety and confidence in terms of money.

For these provided repairing, Bankwest’s Fixed Speed Mortgage has the confidence of being aware what their interest rate and costs will be, Peter teaches you.

Home owners can choose its fixed rate several months in one so you can four age, and repayment volume https://speedycashloan.net/installment-loans-sd/, feel one each week, fortnightly otherwise monthly, which will help somebody carry out the funds.

Before your fix, Peter states it’s worth considering the fresh new implications if you crack the loan within the fixed period, since crack charge you’ll apply.

Exactly what are the loan words and features?

Additional loan providers promote additional financing enjoys which can apply at the loan’s liberty and you may total cost, particularly offset levels, redraw institution, separated financing and you may portability (which is the capacity to transfer the loan to another possessions if you choose to sell an investment).

To help reduce your property financing focus, you may want to hook up a counterbalance account to the mortgage or perhaps capable of making more payments, Peter states.

Otherwise, to make managing your bank account and cost management convenient, you might want even more flexible payment alternatives, the possibility to-break the loan anywhere between fixed and you will changeable, or perhaps to combine your financial situation into your home loan.

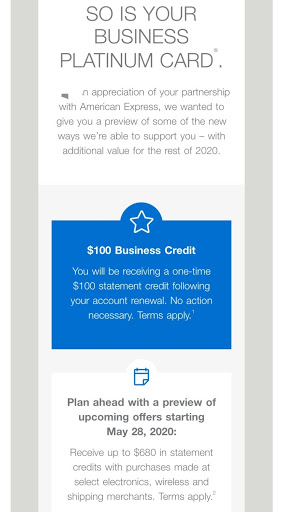

Whenever you are refinancing to some other bank, you might qualify so you’re able to claim cashback also offers, which will help offset any additional charge or loan organization can cost you.

Which are the installment options?

An attraction-merely loan would be an attractive selection for assets traders given that it allows to possess all the way down costs into the attention-just period.

This may free up cashflow to own investors for most other expenditures or perhaps to shelter property expenditures eg repairs or home improvements.

The new cost choice you decide on get a lot to do along with your full plan for your investment possessions. Picture: Getty

This will lead to high total attention costs over the existence of mortgage, while the initial costs is lower.

What other costs should i envision?

It is essential to learn about new initial can cost you that include to buy a residential property since factoring within the costs outside of the put – such government fees – can help you stop offensive unexpected situations.

This really is a state otherwise territory regulators tax which is energized for judge documents as stamped. This new regulations to the stamp obligation will always be subject to transform, so it’s a good idea to check your state or territory government’s casing web site for the most current suggestions.

Peter claims those thinking about to buy another type of possessions features book considerations, for example leverage the brand new collateral within newest profile and you can refinancing its existing loans.

No Comments