Buy property today and you may refinance it after? Here is what masters believe

If you find yourself rising prices is actually air conditioning , rates are still high, and that leaves a great damper to your Americans’ intentions to buy a property or refinance their established mortgages. The fresh new natural question many homeowners was wondering contained in this monetary climate: Ought i get a property today in the high pricing and you may refinance afterwards, or can i loose time waiting for rates to-fall? I posed practical question to numerous a residential property and you can financial experts and you can instructors, in addition to their solutions could possibly get amaze you.

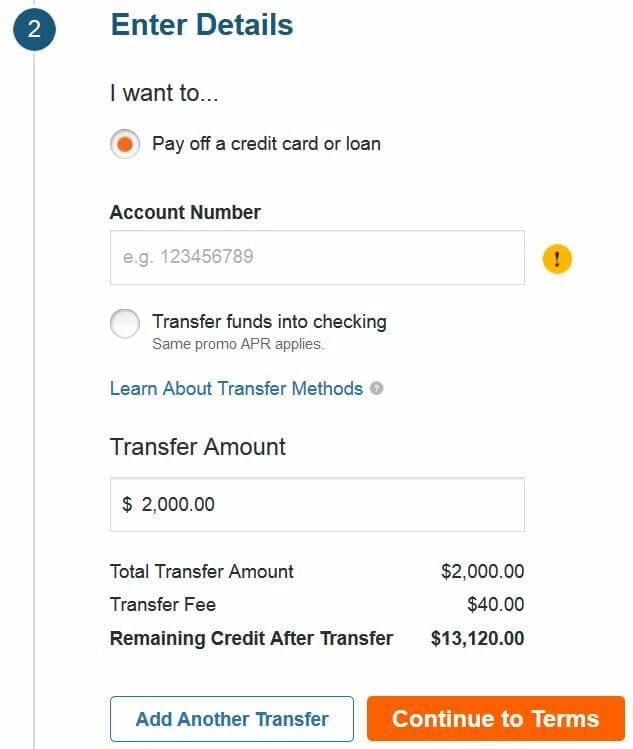

If you’re considering to purchase a new home or refinancing your existing one it can help to understand what rate you can be eligible for.

(read more)