Home loan and you may HELOC Programs: Whats the real difference?

Discover what’s called for whenever applying for sometimes a mortgage or an excellent HELOC and you may what the results are second.

Even though home financing is a fees financing regularly purchase a house and you can property equity credit line (HELOC) is a great revolving borrowing secured by your home’s guarantee, the process to have applying for this type of distinctive line of style of resource was contrary to popular belief similar. See just what suggestions and records you’ll want to provide either in instance, plus what goes on 2nd.

Exactly what data is needed for home loan and you may HELOC software?

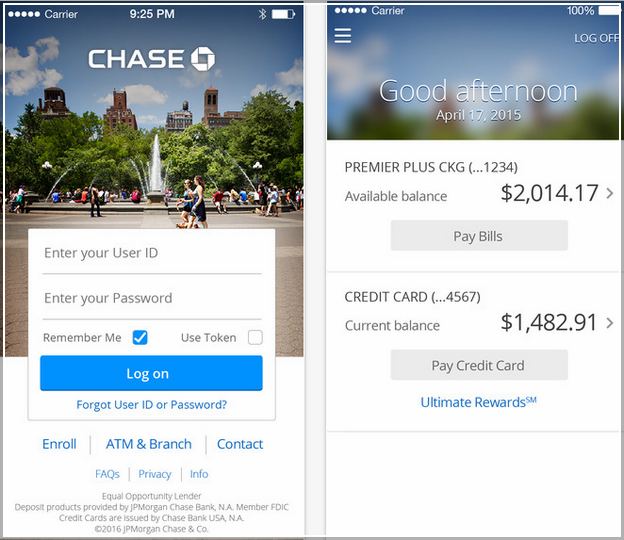

With many institutions, you might done and you will get a mortgage or HELOC on the web, over the phone or in individual at the a community part. Most of the loan providers utilize the exact same standardized Uniform Domestic Loan application (URLA, otherwise 1003 means) to own mortgages. HELOC programs age suggestions, with the second about yourself and one co-borrower (instance a wife):

- Identification: Label, go out of delivery, societal defense amount and license amount.

- Contact details: Street address and phone number.

- Financing request: The total amount you want to obtain in the a mortgage otherwise HELOC.

- Worth of: The purchase price to possess a mortgage otherwise a recent market guess to have a HELOC.

- Employment: Employer’s name and make contact with suggestions, and a career label.

- Income: Month-to-month money regarding jobs, child assistance, alimony and a property holdings.

- Assets: A summary of the bank and you may financing account, together with examining, savings, identity, brokerage, 401(K) and IRA profile, in addition to their balance.

- Costs and you may debts: An offer from month-to-month expenditures, and additionally a listing of debts (e.g., credit cards and you can pupil otherwise automobile loans) with the a good harmony, monthly payment additionally the days left getting term fund.