Home Offer otherwise Lease-to-Own: Which is Most effective for you?

Which question is of Greg in Livonia, just who says,

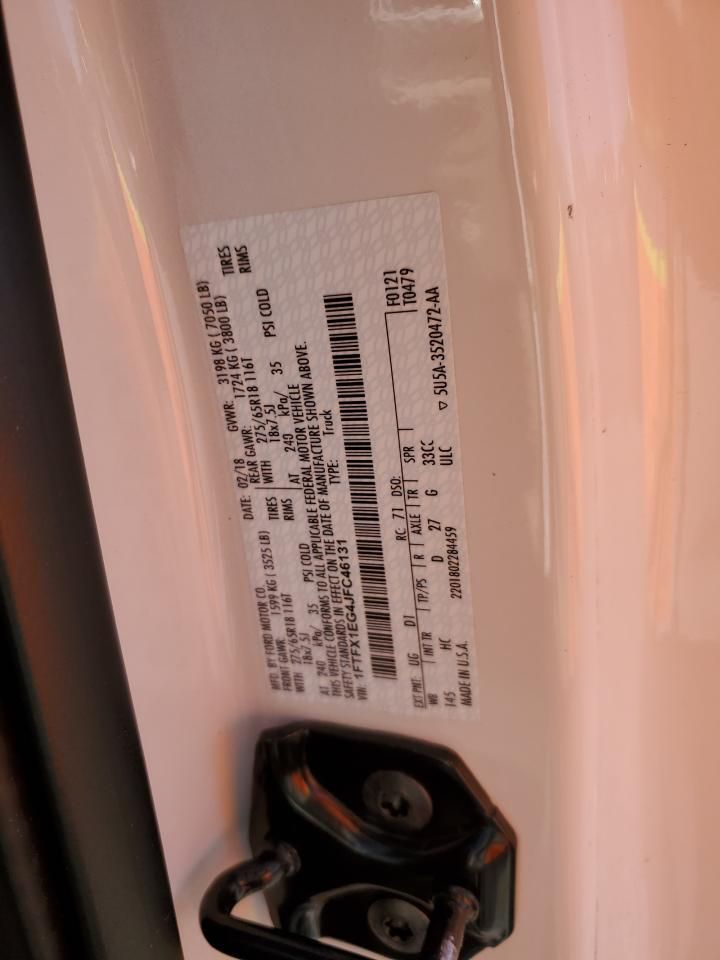

I am provided to shop for a home with my bride to be. The vendor is offering a rental-to-individual program. Is there an improvement anywhere between a lease-to-own system and you may a secure deal? Now, do not qualify for a timeless home loan, but we are taking care of by using all of our financing administrator.

Vendor Resource

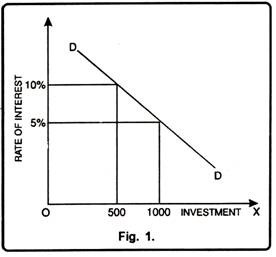

A secure offer is a buy arrangement in which the merchant off a property contains the money with the mortgage, entitled seller funding. They act as their lender. Constantly they have built up guarantee regarding property and are usually shopping for a particular speed out-of come back on money. People the sites agree to revenue terms and conditions including the length of time the customer will have to pay off the sales rate centered on a payment per month and a speeds. The new home price feels like a mortgage because it will include terms and conditions you to definitely handle the brand new obligations of any class. Web browser. Just who pays possessions fees?

(read more)