Exactly what an effective 705 credit score will bring you

Congratulations! A 705 credit rating is good. You should buy most things having an effective 705-also credit rating, provided they suits within your complete monetary thought and you will you can pay back the borrowed funds promptly. While you are good 705 will leave area for update to find the low interest levels and greatest borrowing products, it means that you employ borrowing from the bank responsibly and tend to be well into the the right path. Below discover you skill which have an excellent 705 borrowing from the bank score and you may tips to raise it higher.

Try a good 705 credit history a beneficial?

Sure, based on all the three credit reporting agencies, a credit history off 705 is within the a good variety. They demonstrates to loan providers that you are not risky and you will has presented what you can do to settle fund otherwise personal lines of credit. A credit score regarding 705 would not curb your ventures to own credit cards, auto loans otherwise mortgages. But not, you could have problem qualifying getting business loans.

That have an effective 705 credit history, you have still got the opportunity to raise they large. On the following suggestions, along with automated repayments and you will lease reporting, you could increase credit history in a few weeks.

Predicated on all the around three credit agency get expertise, an effective 705 FICO rating is in the good range. An effective 705 credit rating can be adequate for all those so you can qualify for down interest levels for the money, home loans, and you will car and truck loans. However, you might not qualify for a low rates of interest and may also have specific complications getting acknowledged having commercial or company funding.

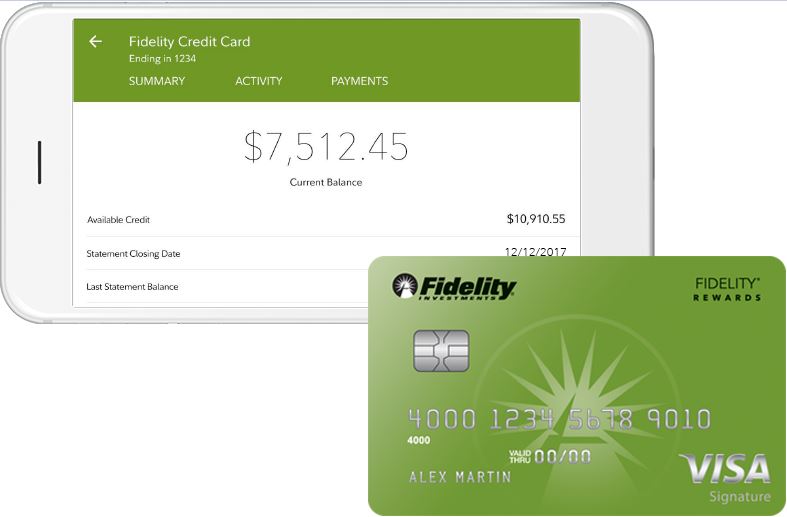

Bank card having rewards

An effective 705 credit score is good enough to qualify for really playing cards. Some lenders get thought earnings, fee history and the quantity of almost every other handmade cards you have applied to have when creating acceptance conclusion. That have good 705 get, you can aquire a top interest, however, if you repay the cards entirely, that wont amount.

A credit score out-of 705 is in the good rating variety, so you’re able to anticipate to become approved for some rewards cards. That is great because mode your be eligible for a variety regarding rewards. Credit card companies provide subscribe incentives, introductory no annual charges, 0% resource, otherwise zero international costs when you yourself have high fico scores. A beneficial 705 credit score mastercard could offer positives such credit card things to score totally free routes, free resorts evening, or cashback rewards out-of $100 so you’re able to $five-hundred or even more.

But simply while the you are approved to possess a great bank card having advantages does not mean you simply can’t possess costs used on your bank account for many who disregard and also make towards the-date payments. In addition to fees, you’ll have a premier charge card interest adding tall will cost you. Afford the credit promptly, in full monthly to possess mastercard rewards becoming a good award!

Home loan

A mortgage loan having a beneficial 705 credit history is obviously you are able to. A 705 credit rating was high enough so you’re able to be eligible for really mortgage loans. However, with a good credit score is not the merely foundation utilized in order to accept your https://paydayloancalifornia.net/pixley/ for a mortgage. Really lenders only approve your for a financial loan equal to one-third of immediately after-taxation money. They are going to think about your revenue, a job history, on-day commission records, the degree of debt you’ve got, or other rating details whenever deciding whether to accept your for that loan.

Most useful car finance rates

Automobile loan providers usually promote best interest levels for those who have a beneficial 740 otherwise 799 credit history. However, an effective 705 credit score is considered sufficient to be eligible for extremely lenders, to however anticipate to rating a significant interest rate provided the rest of your borrowing from the bank portfolio and you will earnings seems good. Whenever you waiting half a year and you may try to boost your credit score, the attention savings to your an auto loan are worth it.

No Comments