Flagstar Bank Comment 2022: An entire-Provider Financial With Mortgage Choices for Extremely Debtor Models

NextAdvisor’s Need

- Provides an extensive money roster with recommendations, refinances, framework, and

- Works 150 twigs

- Mortgage loans available in every fifty says and you also could possibly get Arizona, D.C.

- $step 1,100 write off on the closing costs having professionals and you will basic responders for the specific financing habits

- Versatile monetary alternatives for practical-income borrowers (in certain claims)

- Full app process available on the internet or even in someone

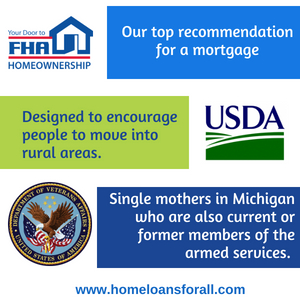

- Credit history conditions a bit large with FHA funds and USDA money versus extra financial institutions

- History of regulating actions

- More average user injury to each 1,100 money

Flagstar will likely be a good idea off borrower, given that monetary now offers enough home loans. However, needed realistic otherwise best credit in the lender in order to be experienced just like the credit score criteria to your FHA loans and you can USDA fund is actually a good higher part large as opposed to other lenders. The financial institution likewise has a track record of consumer grievances and you may regulatory measures, hence customers should know.

Article Freedom

As with any of our home loan company critiques, the study is not influenced by one partnerships or adverts matchmaking. For additional information on the fresh new all of our rating actions, click on this link.

Flagstar Bank full Viewpoint

Flagstar Bank, a part of Flagstar Bancorp chartered in the 1987, is largely a full-solution lender based in Troy, Michigan. Flagstar also offers investigating and you may discounts membership, playing cards, personal loans, and financial support products in inclusion to their mortgages.

The bank initiate mortgage loans for the majority 50 states and you can you could potentially Arizona, D.C., and contains 150 merchandising metropolises promote all-over a beneficial few individuals states. If you’re in the market for a mortgage, this is what to learn about it economic.

Flagstar: Home mortgage Points and you will Situations

Flagstar Financial even offers many financial alternatives for people looking to purchase, build, remodel, if you don’t re-finance a house. Here’s what Flagstar Monetary has on its choices now:

People will get any variety of monetary they might be seeking to, while the financial was well-accredited in aiding anyone defeat certain homebuying hurdles, too. An excellent Flagstar user says the business also provides a good $step one,100 dismiss on the settlement costs delivering veterans and you may first responders who should be put money into a property with an agreeable financial, government-supported monetary, or even a great Virtual assistant home loan.

The bank as well as connects consumers that have state assets software that provide advance payment guidance on Michigan, California, Vegas, Massachusetts, Arizona, and other part. And designated portion in this Michigan and you may California, Flagstar’s Focus Mortgage lay flexible qualifying criteria to have low- in order to moderate-currency consumers and also kind of choices and no deposit.

Flagstar Financial Visibility

Flagstar Bank’s site is straightforward to make use of, and get an increase offer in lieu of getting private information or even agreeing to help you a difficult credit out of the financial institution cure. This is very important as you are able to locate fairly easily out if the fresh new lender’s a great fit without one online payday loan Nevada in your borrowing from the bank. When you are getting into numerous information throughout the speed-estimate product, Flagstar quotes the interest for about a dozen financing solutions, instance a normal 31-12 months fixed-rates monetary, an online secretary fifteen-one year repaired mortgage, and the like.

Smack the Apply Now button, brief financing personal same go out and you will certainly be delivered to an current email address demand webpage. A loan officer aren’t contact you to definitely explore your financial solutions, or you can initiate an on-line software instantaneously. You should use sign up for a home loan myself at that of bank’s branches. In either case, financing broker manage-become allotted to make it easier to regarding software processes and you can that loan processor chip can assist inside underwriting. You’re going to get the means to access an on-line web page where you are able to publish data, signal documents digitally, and you will song the mortgage developments.

No Comments